| November 28th, 2019 |

Third Party Payment Processors — Are They Right For Your Business?

In this highly competitive business era, setting up or running a business is really a big challenge. There are lots of difficulties that business owners inevitably face. The first obstacle, without any doubt, is to sustain in business. Next to that, a business owner has to decide how he will process the payment transactions. This is one of the most challenging and big decisions that creates lots of confusions and questions in the minds of business owners. In this guide we will discuss about third party payment processors.

Actually, there are two ways to process customers payments and both have some pros and cons.

- Merchant account

- Third Party Payment Processor

These days, most small and middle scale businesses prefer third party payment processors because they do not want to go through the long and complicated merchant account process. Moreover, they also think that merchant account services are costly when compared with third party payment processing.

What is third party payment processor?

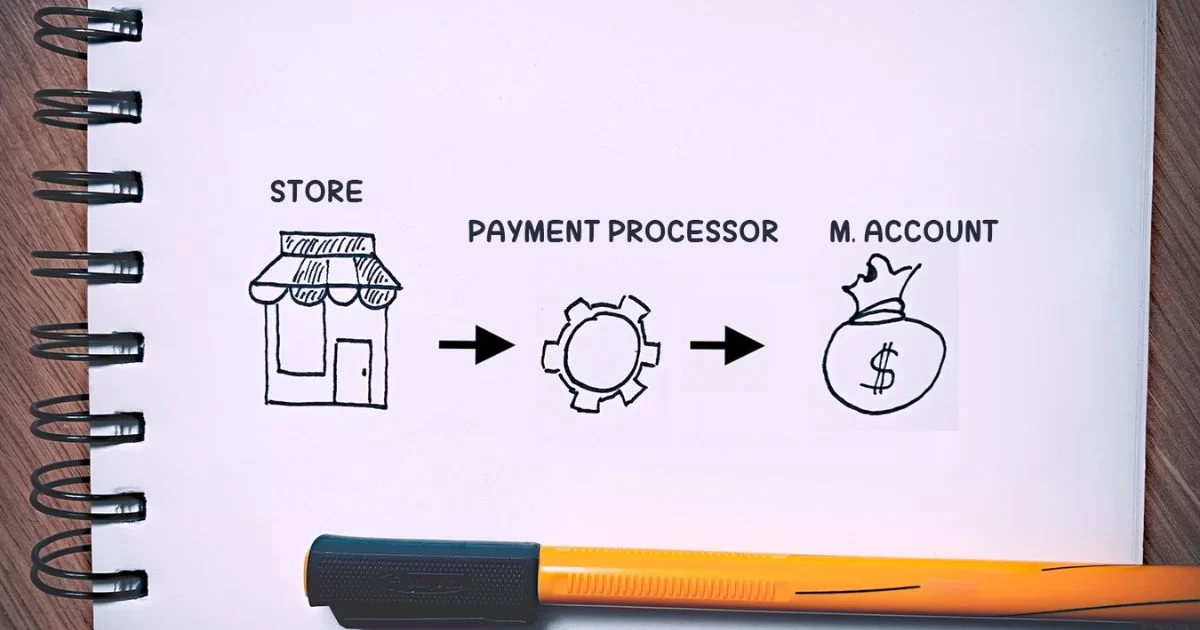

Third party payment processor is a service that lets business owners accept online payments without a need of a merchant account.

In this service, a business uses merchant account of its third party payment processing company. The key objective of companies that provide this service is to make payment processing activities as hassle-free as possible for businesses.

These companies use one merchant account to provide payment processing services to all businesses.

Some Key advantages of third party payment processors —

Fast :

The main benefit is that the entire process is very fast and easy to manage. This is ideal for start-up and small scale companies. Customers payment processing can be started instantly after sign ups and there is no need to go through a long complicated and underwriting process that is usually required in merchant account payment processing.

No Monthly Fess Involved:

Rates of third party payment processors are often lower than traditional merchant account service providers. Moreover, third party processing companies do not charge fees on monthly or annual basis. They also do not demand additional fees for services like PCI compliance, payment gateway management etc.

Easy cancellation Process:

Most traditional merchant account companies generally make long-term contracts with automatic renewals that prohibit businesses to cancel the deal in case of need. To cancel the deal, business owners have to pay high cancellation fees in the form of penalties.

Thankfully, there is no such condition involved with third party payment processing companies. A business owner can cancel the agreement any time without paying any cancellation fees.

Instability:

Although these companies do not go through detailed underwriting in advance, they may cancel the deal or agreement if they find any inappropriate account. Most of the time, companies do not even give any notification to the client.

Less Reliable Customer Support:

As most third party processor companies operate online, it may happen that customer support services over the phone would not work in a way it should be. Clients need to go online whenever they need customer support.

Higher Transaction Fees:

It is true that third party processor companies do not charge setup or monthly fees. However, they make money by charging on every transaction, which in total many times becomes higher than what traditional merchant account companies charge on monthly or annually basis.

Third party payment processor or merchant account — What is better for your business?

If you want to avoid the lengthy & complicated account opening process or if convenience is your top priority, then third party payment processing would be the best option for you.

However, always remember convenience always come with high price.

If you process lots of transactions every month, then you should go for merchant account services as third party processors charge on transaction basis and not on monthly basis.

Merchant account is best for companies that do not want to take the risk of losing their alienating customers that may happen due to unpredictable situations like technical issues, shutdown, etc. Increased security, low charges per transaction, and no risk of sudden shutdowns are key benefits of merchant account

However, the main disadvantage of setting a merchant account is that it is a very time consuming and complicated process.

Conclusion —

For start-up and small businesses, third party processors are just like boon that help them accept online payment and grow business globally. However, it is better for businesses to switch to merchant account services after they start earning enough revenue. So if you want to accept online payments, choose either merchant account or third party payment processor according to your business type, scale and number of online transactions you process in a month.