| March 27th, 2024 |

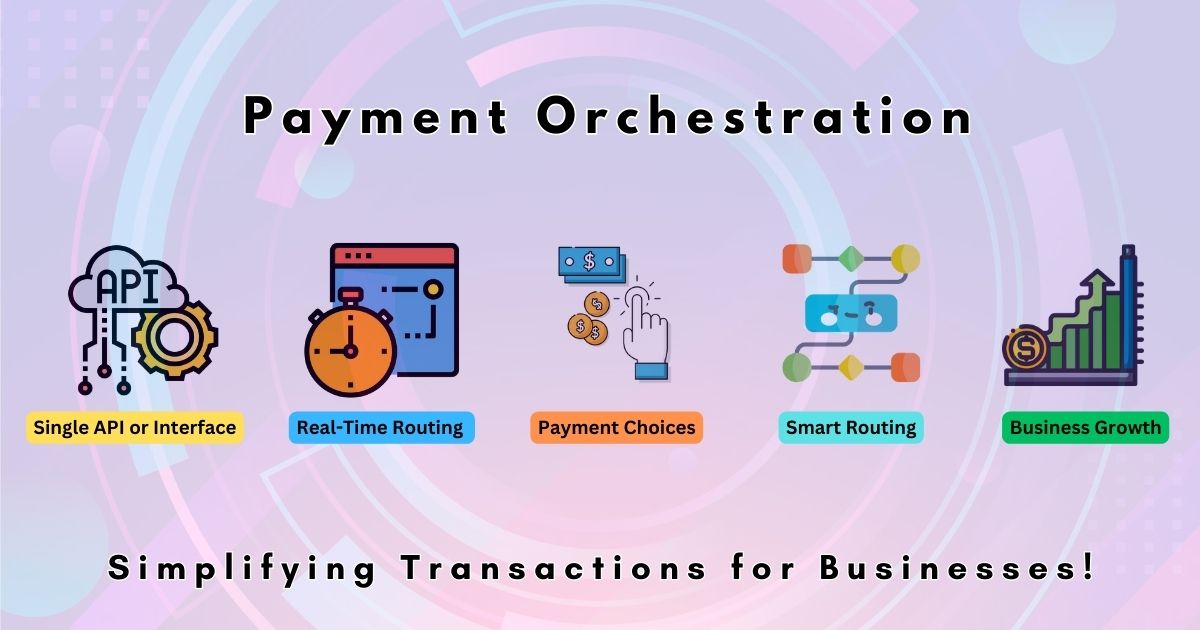

The Power of Payment Orchestration — Simplifying Transactions for Businesses!

In the current digital world, businesses are continuously looking for creative ways to improve customer happiness and streamline processes. Payment orchestration is one such option that has become rather popular. However, what is payment orchestration really, and how can organizations take use of it? We’ll get into every aspect of payment orchestration in this extensive guide, covering its definition, features, advantages, and applications for businesses looking to streamline their payment processing.

What is Payment Orchestration?

A sophisticated strategy for organizing and streamlining payment operations across several channels, payment methods, and geographical locations is called payment orchestration. In essence, it acts as a single hub that lets companies easily receive and handle payments from a range of sources, such as bank transfers, digital wallets, credit and debit cards, and other payment options.

The intelligent routing of transactions based on predetermined criteria, including cost, speed, dependability, and user experience, is the fundamental component of payment orchestration. This guarantees that every transaction is sent through the payment gateway or payment processor that is the most productive and economical, increasing acceptance rates and lowering processing costs.

Key Functionalities of Payment Orchestration —

Unified Integration:

Through a single API or interface, payment orchestration systems enable businesses to easily connect with a number of payment gateways, processors, and acquirers. This is made possible by their standard integration capabilities. This saves time and money by doing away with the requirement for complex interfaces with different payment providers.

Dynamic Routing:

Using pre-established rules and parameters, payment orchestration allows for the dynamic, real-time routing of transactions. This optimizes success rates and reduces transaction delay by ensuring that every transaction is routed through the most appropriate payment method or gateway.

Payment Method Optimization:

Businesses may improve their payment methods with payment orchestration by taking into account variables including transaction costs, consumer preferences, and local regulations and compliance. This guarantees cost-effectiveness and compliance while enabling businesses to provide a wide variety of payment choices.

Smart Routing:

Payment orchestration solutions use machine learning and advanced algorithms to intelligently route transactions according to variables like fraud risk, transaction volume, and currency conversion rates. This allows businesses in maximizing profits and reducing losses brought on by fraudulent or failed transactions.

Benefits of Payment Orchestration —

- Improved Conversion Rates: By offering a diverse range of payment options and optimizing transaction routing, payment orchestration helps businesses improve conversion rates and reduce cart abandonment rates.

- Cost Savings: Payment orchestration enables businesses to optimize transaction costs by routing transactions through the most cost-effective payment methods and gateways, ultimately reducing processing fees and increasing profit margins.

- Enhanced Customer Experience: With faster transaction processing, seamless payment experiences, and support for preferred payment methods, payment orchestration enhances the overall customer experience, leading to increased customer satisfaction and loyalty.

- Global Expansion: Payment orchestration facilitates global expansion by providing support for multiple currencies, languages, and payment methods, allowing businesses to reach new markets and customers with ease.

- Scalability: As businesses grow and evolve, payment orchestration scales effortlessly to accommodate increased transaction volumes, new payment methods, and changing business requirements, ensuring long-term scalability and flexibility.

How Businesses Can Leverage Payment Orchestration —

Evaluate Business Needs: Assess your business requirements, including transaction volume, geographic reach, preferred payment methods, and scalability requirements, to determine the most suitable payment orchestration solution.

- Choose the Right Provider: Select a reputable payment orchestration provider with a proven track record of reliability, security, and innovation. Look for features such as unified integration, dynamic routing, and robust analytics capabilities.

- Customize Configuration: Customize the payment orchestration platform to align with your business objectives, including defining routing rules, optimizing payment methods, and integrating with existing systems and processes.

- Monitor Performance: Regularly monitor and analyze transaction data, conversion rates, and customer feedback to identify areas for improvement and optimization within the payment orchestration ecosystem.

- Stay Agile: As technology and consumer preferences evolve, stay agile and adapt your payment orchestration strategy accordingly to capitalize on emerging trends and opportunities.

Conclusion —

With the help of payment orchestration, businesses may improve customer experiences, maximize revenue streams, and expedite payment processes. Payment orchestration enables businesses to achieve more efficiency, cost savings, and scalability in today’s competitive landscape by utilizing cutting-edge technologies and smart routing algorithms. Adopting payment orchestration is a basic requirement for companies hoping to succeed in the digital economy, not just an economic advantage.