| March 10th, 2023 |

United States of America and the Payment Systems!

Payment, at its core, signifies the exchange of money, serving as the pivotal moment that relieves a payer from a debt owed to a payee. This intricate financial process is facilitated through a structured system comprising various tools, banking practices, and interbank money transfer mechanisms, collectively ensuring the seamless flow of cash.

Section 1 — The Crucial Role of Payment Systems:

A payment system is not merely a transactional process but a meticulously planned method for participants to transfer value. Its significance reverberates across all financial economies, regardless of their developmental stage. Central banks, as the issuers of currency, exhibit a profound interest in the smooth operation of the national payment system, evolving their role over time to maintain confidence in the currency and guarantee its circulation.

Section 2 — The Evolution of Digital Payments:

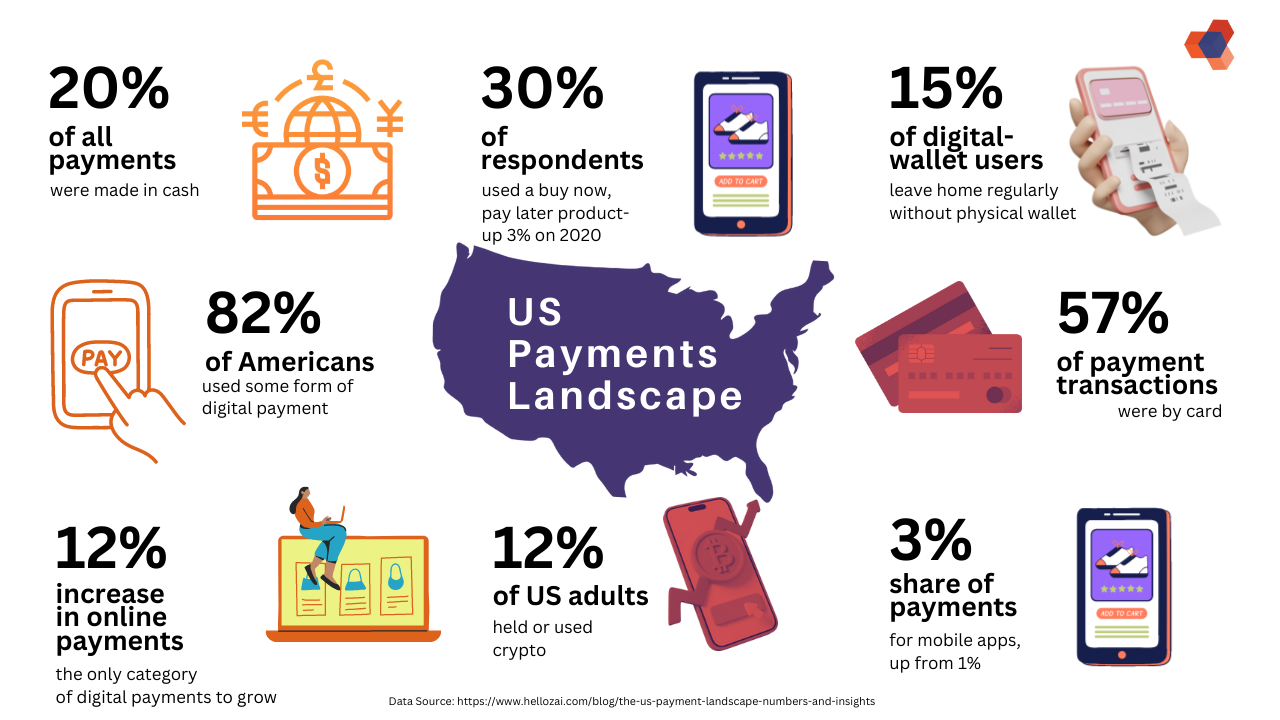

In the year 2021, digital payments witnessed a significant surge, with 82% of Americans utilizing various digital payment methods. This includes person-to-person (P2P) transactions, browser-based, or in-app online transactions, surpassing previous years’ statistics. The landscape of payment systems has been transformed by technology, mergers, acquisitions, and the introduction of innovative payment methods.

Section 3 — The Changing Face of the Payment Industry:

Technology-driven advancements have given rise to a new breed of players in the payments industry, redefining the customer experience and simplifying business operations. The integration of technology companies with traditional financial institutions is becoming more prevalent to meet the evolving demands of clients and merchants.

Section 4 — Players in the Payments Ecosystem:

The intricate web of the payments ecosystem comprises issuers, acquirers, credit card networks, payment systems, payment gateways, independent sales organizations, value-added resellers, and payment mediators. Each entity plays a distinct role in the cycle of payment processing, contributing to the efficiency of the overall system.

Section 5 — Fintech’s Ascendance in Mainstream Adoption:

The synergy between large tech and banking has propelled fintech into mainstream adoption. A recent survey by Plaid indicates that more Americans now use fintech than popular services such as video streaming subscriptions and social media. Fintech’s rapid rise, coupled with consumers’ preference for newer, faster, and potentially safer payment methods, underscores the dynamic nature of the payment services landscape.

Section 6 — Emerging Trends in Payment Technology:

The payments industry is witnessing a continuous evolution driven by emerging trends in payment technology. This includes advancements such as blockchain-based transactions, contactless payments, and the integration of artificial intelligence in fraud detection and prevention.

Section 7 — Regulatory Landscape and Compliance Challenges:

The rapid transformation in payment systems brings forth new regulatory challenges. Compliance with evolving regulations, especially in the context of cross-border transactions, becomes crucial for the sustainable growth of the payment industry. This section explores the regulatory landscape and the challenges businesses face in staying compliant.

Conclusion — Navigating the Changing Tides:

The constant evolution of payment systems necessitates a nuanced understanding of the industry’s dynamics. As fintech gains prominence, the competition intensifies, making it imperative for businesses to place trust in platforms that ensure financial stability. This trust becomes paramount for the efficient operation of systemically important payment, clearing, and settlement processes. Staying abreast of emerging trends and regulatory changes is crucial for businesses aiming to thrive in this dynamic landscape.